On the Margin

Sunday, June 9, 2019

Update: This article was included by Business Insider alongside other learnings from Henry Ward (founder and CEO, Carta), Sahil Lavingia (founder and CEO, Gumroad), and Patrick McGinnis (creator of the term “FOMO”).

This is my personal post-mortem of Margin. Please keep in mind that everyone (team members, investors, customers, users, etc.) has their own perspectives that should be respected even if they may differ from mine.

Margin began with the ambitious vision to change consumers’ understanding and expectation of retail prices.

The idea was simple: buy something today but pay tomorrow’s price.

So how did Margin fail when backed by the biggest retail and financial services leaders in the world? How did two related but distinct markets shift so substantially that we could not see the venture to success?

It all started with a trip to my local REI in SoHo.

After I bought hiking poles for a trip to Yosemite, I discovered and used a magical concept called “price protection” — an often unknown and rarely used reward benefit intended to motivate consumers to buy an item today but receive a refund for the difference if the item should go on sale within a specific time period.

With this benefit, I got a cool $50 refund for my hiking poles from my credit card issuer, Chase, but still received immediate utility from the poles before they even went on sale.

As I started digging deeper, I learned that Chase wasn’t the only card company offering this benefit. Barclays, Capital One, Chase, Citi, Discover, Mastercard, Visa, Wells Fargo, and most others offered their own versions of the reward, as well as hundreds of retailers including Best Buy, Target, and Walmart.

I began chatting about my recent savings experience and newfound learnings with friends and family. Each person was unaware of this benefit but remarkably fascinated by its unique value.

But my conversations with Scott Howard, someone Union Square Ventures had introduced me to years before, were really what most excited me. Scott’s talent was obvious as the founder of Chobani’s incubator and recently moving over to Anheuser-Busch’s ZX Ventures, all while acting as a mentor to Backstage Capital and Rubicon VC.

As we dove deeper together, we discussed our vision with card issuers who explained that use of the reward significantly influenced their cardholder spend and loyalty.

We became energized by the idea’s viability, and Scott asked to invest. Instead, I convinced him to quit ZX Ventures to join full-time as my co-founder.

Market Armageddons

As we grew the team and built our MVP (minimum viable product) over the next nine months, our ongoing discussions with card companies began to soften and their enthusiastic language of certainties and assurances began turning into generalizations and hesitancies.

Within weeks of our intended beta MVP release, the news came.

Chase announced it was cutting many of its card benefits.

Citi responded hours later announcing its own cuts.

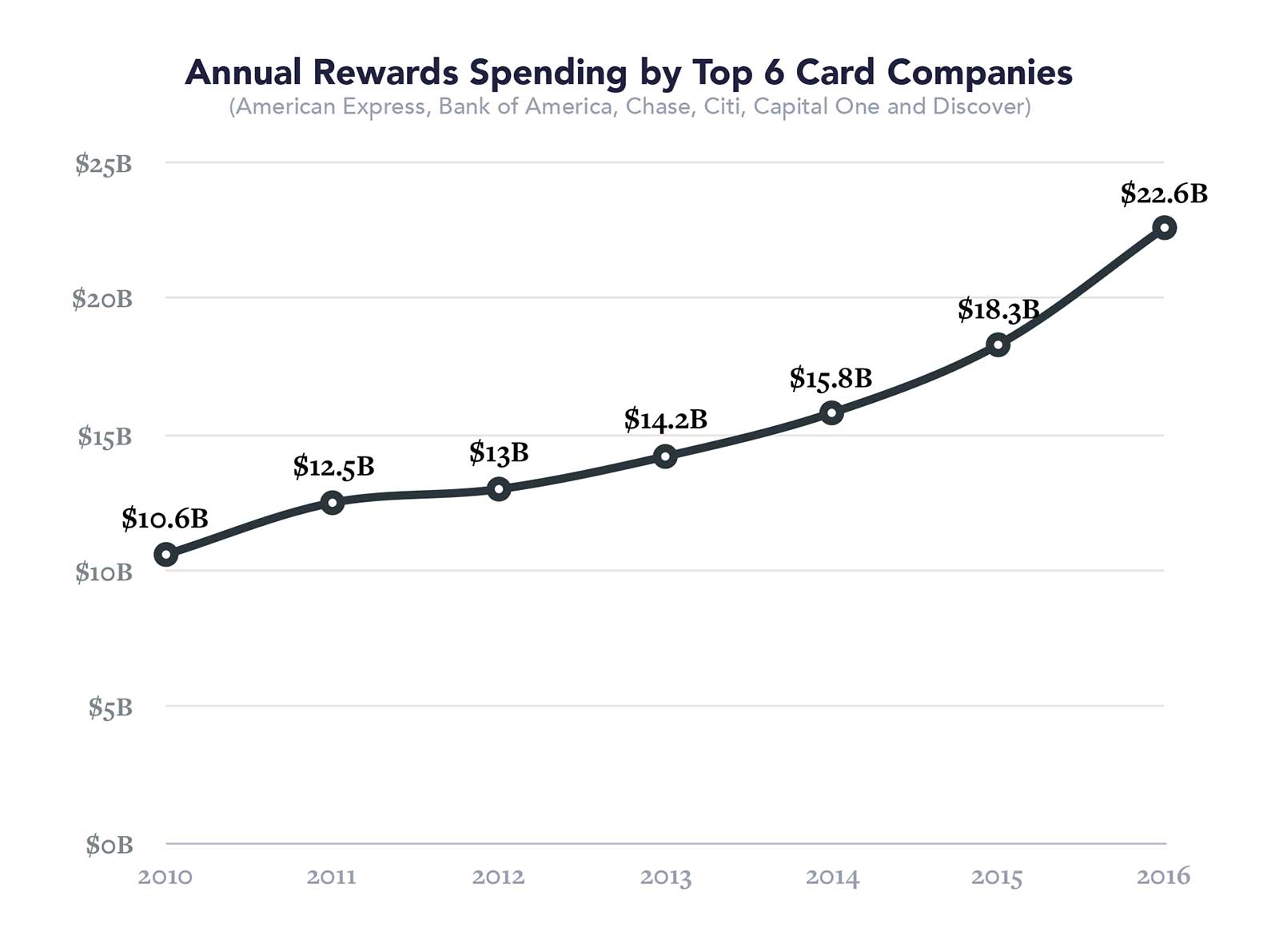

The Wall Street Journal then published a cover story, “Why the Credit-Card Boom May Have Just Peaked: Card Lenders are Feeling the Pinch as Loan Losses and Rewards Expenses Rise.”

“…the cost [issuers] incur from so-called gamers, who search for the highest rewards on their cards. These consumers sign up for credit cards with rich sign-up bonus offerings and then stop using the card once they have tapped out the early rewards.”

As the cardholder acquisition race had accelerated over the years, the lucrative sign-up bonuses offered by card issuers had incentivized “card churning” and resulted in a sharp decline in retention and LTV rates.

The card issuers chose short-term profitability over long-term retention by cutting annual card benefits to stabilize losses in the hopes of possibly earning a profit from new cardholders before their inevitable churn.

Chase revealed that its card services revenue fell by 25% in two years and its net charge-offs (debts unlikely to be paid) increased by 32%.

Within less than ten years, annual reward spend by the leading six U.S. card issuers had more than doubled.

The CEO of Discover said, “The industry was at an unsustainable high…so coming down is expected,” before announcing all Discover cards would end their six benefits:

- car rental insurance

- flight insurance

- purchase loss and theft protection

- return guarantee

- extended product warranty

- and, yes, price protection

As card companies struggled with unsustainable sign-up bonus offerings and churning, the groups responsible for servicing the annual benefit policies — major insurance agencies like Allianz, AIG, and TPG — faced their own separate threat.

While we correctly guessed that our success would increase insurer payouts, we also predicted that our optimized processes would decrease servicing costs so the insurers’ “combined operating ratio” (the underwriting profitability of a policy) would remain favorable.

What we failed to predict was that our competitors (in the form of bots) would skyrocket fraudulent price protection claim rates to more than 30% and send individual claim requests for as little as $0.14, causing insurers to file emergency policy endorsements (amendments) en masse.

As card companies and insurers both struggled with profitability, consumer retailers continued facing an existential crisis known as the “Amazon Effect.”

This ongoing phenomenon has resulted from the consumer belief that Amazon has the best selection at the best price with the fastest delivery. To further perpetuate this mindset, Amazon has demonstrated its willingness to build or buy any service that shortens the “Consumer Decision Journey,” the purchasing process consumers engage in from identifying a need to post-purchase learnings.

In 2018, the “retail apocalypse” — as many experts dubbed it — resulted in record losses, store closures, and bankruptcies including legendary Sears.

These foundational changes for card companies, insurers, and retailers — all occurring within a six month period — profoundly affected our original vision and approach. Our only path, as is true with all startups, became to adapt quickly to market changes.

Great Existing Investors and a Disappointing Next Round

We raised a $1 million pre-seed round from many of the heaviest hitters in retail and financial services.

From the chairman emeritus of the National Retail Federation, former CEO of Saks Fifth Avenue, senior advisor to Mastercard, co-founder of Gilt Groupe, co-owner of Michael Kors and Tommy Hilfiger, creator of The Carlyle Group, and co-founder of NEA, we also had senior executives from nearly every powerhouse including JPMorgan Partners, Goldman Sachs, Certares, and Virgin.

In retrospect, we justified the smaller $1M round because we expected Margin to operate as a low-cost, profit-driven business that would generate immediate and significant revenue.

Following the market changes, it became clear that success was less probable, so we even debated returning the remaining capital back to our investors.

After seeking feedback from our largest checks, they encouraged us to continue onwards but warned of less support moving forward as they’d be busy facing the existential crises of their multi-billion dollar companies.

Our homogenous investor composition, in hindsight, became a significant risk. We probably should’ve returned the remaining dollars in the bank as our vision had become so materially compromised that any path forward did not represent their initial investment intention.

Regardless, I was honored and humbled by our investors’ willingness to believe and fund our vision, and I’ll always be grateful for their support.

After a strong fundraise in December 2018 to raise an additional $2.5 million and partner with a leading retailer, an underwhelming, unfortunate outcome resulted in the round falling apart.

Our team then made tremendous sacrifices to stretch our original 14 month runway to 17 months, but it wasn’t enough as we needed significant additional capital to provide flexibility.

It served as a perfect representation of far too many startup journeys: take money when it’s on the table because one day you may need it and it may not be there anymore.

Repeatedly Changing Product with Market Changes

Our price protection product leveraged OCR (Optical Character Recognition) and ML (Machine Learning) to identify purchased products from user-submitted receipts. We’d then match the purchased product to identical ones available online at that moment and in the future, all before a human would submit the final claim to the insurer. Our hope was the product would self-refer customers to credit cards featuring price protection.

After we experienced the credit card market change, we modified the approach to leverage the price match policies offered by 100+ major retailers, expanding our serviceable market to users without credit cards with price protection.

And, yet again, another seismic change occurred as Google announced new industry-defining privacy changes, which meant that no data acquired through Gmail could be used for market research, a critical revenue stream for Margin.

So we began spending more time with retailers including Walmart’s incubation arm Store Nº8, a great and thoughtful partner. Eventually, we discovered the pricing panacea: proactive price matching through refunding the difference as time-expiring reward gift cards. The gift card would either be spent (in many multiples, as we saw in our experiments) or never even used while resulting in a happier, more loyal customer.

Unfortunately the discovery came too late in the company’s journey.

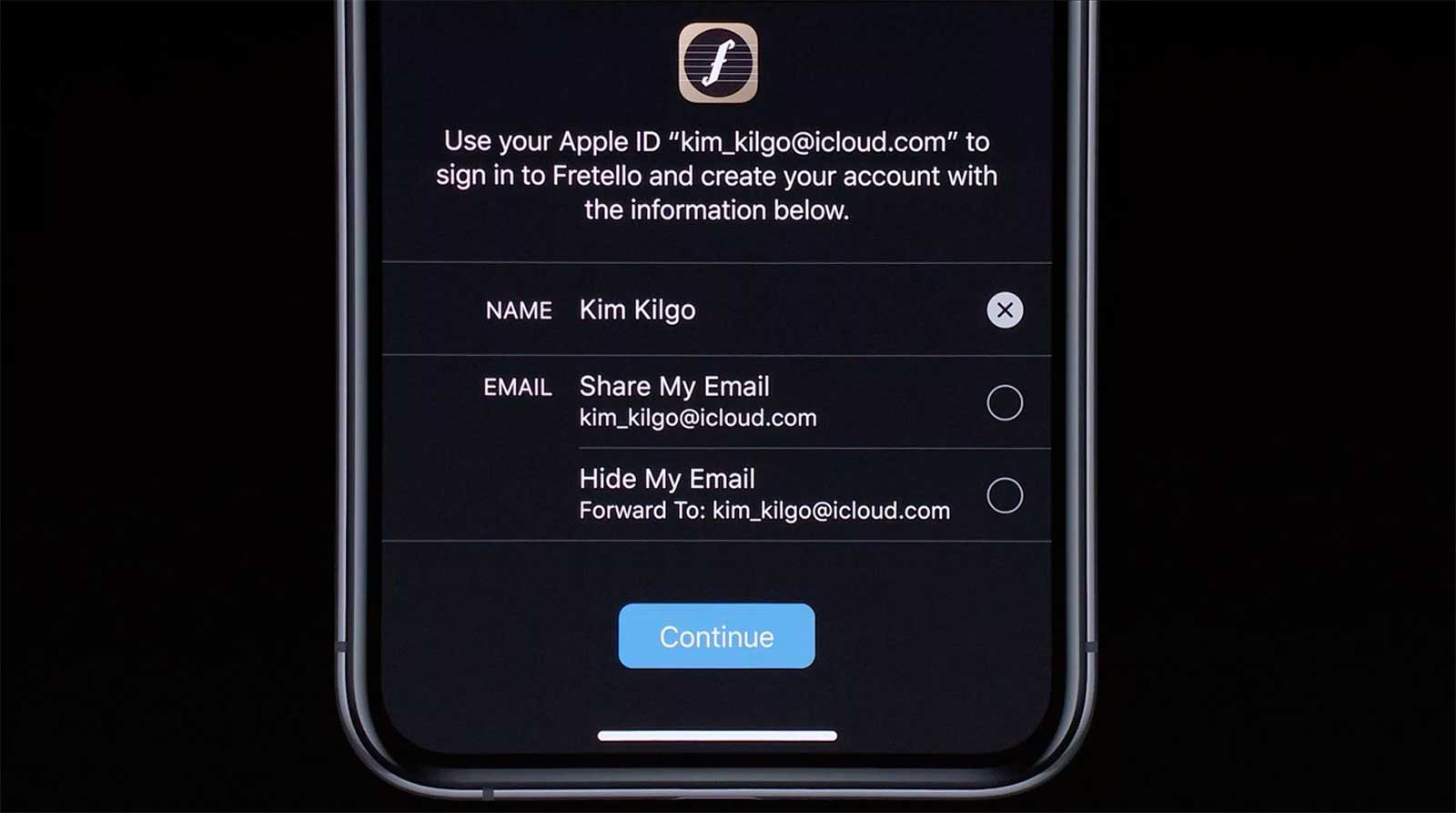

With only a month of remaining runway, we pivoted hard to focus on the 43% of consumers who use throwaway email addresses for marketing emails.

We rapidly prototyped and released an email alias product to intelligently forward emails to a consumer’s personal email address (or block them!) based on customizable filters.

Our updated product became Product Hunt’s #2 App of the Day and was immediately loved by a small but avid user base.

Even the global leader in email deliverability, Return Path, said, “We’ve never seen anyone do this with email. You’d become the largest email sender in the world.”

Despite the initial traction, it was just too late to see the company to success, and we winded it down.

In an ironically validating move, Apple released a similar product later at the Worldwide Developers Conference 2019.

As Apple SVP Craig Federighi explained, “This means you can disable any [disposable email address] when you’re tired of hearing from that app.”

The audience clapped in thunderous applause.

Inspiring, Dedicated Team

Throughout the experience, the importance of finding the right people with brilliant minds willing to work together to achieve a collective vision weighed on me.

When they’re the wrong fit, you normally already know. And when they’re right, you build trust with them, learn from them, and help them grow.

Margin’s team was comprised of some of the most brilliant people I’ve ever worked alongside. Scott, Clive, Wenzhi, Aman, Dan, Petrina, Adam, and John worked as collaboratively and cohesively to fight for success as any team.

Now three months after winding down, the team continues to chat daily on Slack and regularly discusses the desire to “get the band back together.”

And, lastly, there’s my co-founder, Scott. As a leader, I’ve always believed in my responsibility to find, excite, and recruit people smarter and more capable than myself. I’ve never enjoyed working with someone as much as Scott, and likewise there’s no one in the future I hope I can work with again as much as him.

After many startups now, I recognize how meaningful it is to have the right partner throughout the entrepreneurial journey. A special thanks for his partnership, friendship, and collaboration through the frustrating lows and exhilarating highs.

Some final learnings

- Minimum Viable Product includes “minimum” for a reason. A product can always look prettier and receive new features that users demand. Perfection comes at a price, and I should’ve been more comfortable releasing a less-polished product into the market.

- Signed agreements are critical. In hindsight, Margin should’ve only advanced from an idea to a company with a signed partnership agreement from at least one card company. Despite their excitement for our vision, the risks were simply too great that policy terms would be changed without agreement protections.

- Objectively analyze the market. We saw the initial signs that the card services industry may soon implode but wrongly believed we could save it. We doubled-down instead of reacting faster. Had Margin started a year earlier or a year later, it may have been a different outcome.

- Find product/market fit fast. Easy to say now, but had we aggressively met with retailers earlier we likely would’ve landed on the expiring gift card concept faster.

- Balance time and money. As Scott frequently said to the team, “Startups are just a function of time and money. The more money you have, the more time you have to find the solution.”

- Investors can’t create success but can help lead to failure. Great investors show their support (and true colors) in the bad times. Also, target investors whose portfolio mirrors the venture’s stage to avoid false signals, wasted time, and a possible irrecoverable position.

- Walk first, run second. We got too big of an office far too early. Work environments matter but not at the considerable expense of runway.

- Thoughtful counsel is invaluable. A special thanks to Greg Heibel, Steve Venuto, and the Orrick team for joining me yet again on another startup. They’ve become friends, and in the process, I’ve discovered that great startup counsel are more like company advisors than attorneys. Likewise, a deep appreciation to Andre Marais and SLW for their relationship.

- Constantly analyze whether the sacrifices are worth it. Startups require incredible passion, energy, and time. When things go well, it’s easier. When things don’t go well, it’s much more difficult. Emotional, physical, financial, and spiritual health all suffer. I want to thank my family (especially Jordan & Beth) and friends for their support, understanding, and encouragement over the journey.

And with that, onwards and upwards.